Where a $6 Billion Hedge Fund Sees Opportunity |

Date: Tuesday, December 3, 2013

Author: Asit Sharma, The Motley Fool

Tiger Global Management, the nearly $6 billion hedge fund run by Julian Robertson protégé Charles Coleman, employs an investment style that thrives on technology-driven global consumerism. Browse through the fund's holdings in any given quarter and you'll see a mix of consumer goods and technology stocks, with many positions combining characteristics of each, such as top holding Priceline (NASDAQ: PCLN ) and lesser known international payments processing provider Fidelity National Information Services (NYSE: FIS ) . Recent additions and dispositions in the fund's portfolio hold true to this theme. Let's review some trades from the most recent quarter, ended September 30th, 2013, to get a feel for the fund's strategy.

A vote of confidence in a resurgent Internet stock

During the period, Tiger Global initiated a position of 8 million shares of Yahoo! (NASDAQ: YHOO ) during the last quarter. Yahoo shares have returned 136% since Marissa Mayer took over as CEO in July of 2012. Mayer's business strategy of "people then products then traffic then revenue" has won an avid following on Wall Street, and Tiger Global has officially joined the group of well-capitalized devotees. At 4.4% of total portfolio value as of 9/30/2013, Yahoo is now the fund's sixth-largest holding.

Because Charles Coleman applies a fundamental analysis approach to stock selection, Yahoo! makes sense as a significant new trade. For most of this year, Yahoo has traded at single-digit multiples of trailing twelve month earnings. During the quarter in which Tiger Global built its position, the stock traded at a P/E ratio between 7 and 9.5.The company's many years of profitable operation built on the engine of Internet advertising have resulted in a richly armored balance sheet: current assets on the books of $3.5 billion could pay for long-term liabilities nearly 30 times over. In addition, Yahoo currently trades at only 3 times book value.

Combine these attractive characteristics with Yahoo's 24% stake in Chinese e-commerce giant Alibaba, and you can see why Yahoo suits a fundamentals-based strategy like Coleman's so well. According to a recent Bloomberg article, Alibaba's much anticipated IPO will transpire in 2014, and some investment banks have valued the company at $120 billion, making Yahoo's stake, recorded at $807 million on its books, worth nearly $29 billion.

The ink dries on a successful turnaround-based trade

On the pruning side of the portfolio, the fund dispensed with its less-than-one percent position in R.R. Donnelley & Sons (NASDAQ: RRD ) . Donnelley, the largest commercial printer in North America, has sought to restructure its business over the last several years, offering more digital services as its print business declined. The company has completed recent acquisitions to add revenue outside of the high fixed overhead of the printing business, including crowd-sourced content network Helium.com and popular financial website Edgar Online.After a multi-year implosion, Donnelley stock has rallied 108% in 2013 year-to-date. SEC filings show that Tiger Global initiated its position in the first quarter of 2013. After disposing of the entire position during the last quarter, the fund likely enjoyed at least a 40%-plus gain on this trade.

A prototypical Tiger investment

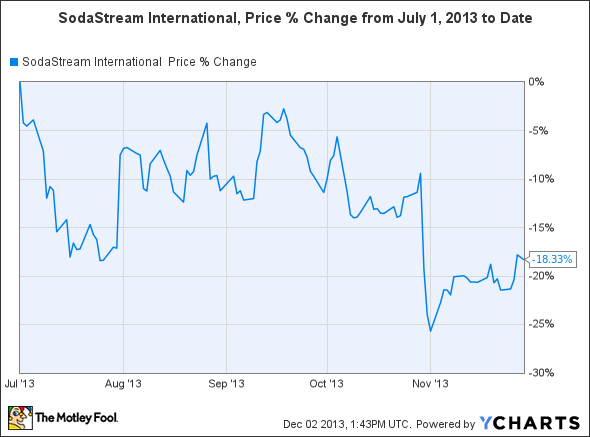

Tiger Global quenched some of its thirst for risk by initiating a position in carbonated beverage upstart SodaStream International (NASDAQ: SODA ) . This investment is emblematic of Coleman's style, as SodaStream combines a consumer-oriented business with technological innovation. The manufacturer of personal carbonated beverage machines had gained nearly 70% through the first half of this year. However, the stock peaked in June of this year, and has declined steadily since then, so it is likely that Tiger Global, which bought shares in the third quarter, is losing money on the trade thus far:

Investors in SodaStream may have some misgivings about potential competition from Green Mountain Coffee Roasters (NASDAQ: GMCR ) and Starbucks (NASDAQ: SBUX ) , which both appear to be ready to enter the already crowded battleground for carbonated beverages. Green Mountain has filed a trademark application for a carbonated beverage machine under the name "Karbon." Starbucks has filed a trademark application for "Fizzio," its own carbonated beverage maker. As Fool contributor Andrés Cardenal points out, SodaStream probably has more to fear from Green Mountain, as Starbucks has publicly stated that it has no intention to sell a home-based machine in the near future. These competitive threats arise just as SodaStream has launched its "Caps" line of fruit flavorings, the Company's initial foray into disposable, single-use flavor capsules.

Despite the pressure from well-heeled peers, SodaStream likely appeals to Tiger Global on a few levels. As a consumer goods company offering a technological innovation, SodaStream fits a thematic profile that seems to characterize the fund's investments. In addition, the company exhibits exceptional growth, an investment trait the fund tends to favor. Below is a chart of SodaStream's trailing twelve month revenues and net income since going public in November of 2010. Notice the steep revenue slope and almost linear progression of net income as the top-line increases:

SODA Revenue (TTM) data by YCharts

SodaStream is investing in its future growth, using a significant amount of cash generated from operations in 2013 to invest in a new production facility en route to a stated goal of reaching $1 billion in sales in 2016. For reference, the company's current trailing twelve month revenues stand at $527.6 million. Tiger Global likely views this as a long-term holding, but at 0.42% of the total portfolio as of 9/30/2013, the position can either serve as a building block for additional shares, or a shorter trade should SodaStream see its path truly obstructed by new entrants into the single serve, on-demand carbonated beverage market.

Before you invest, a note of caution

While you should take care not to base your investment decisions solely on a hedge fund's holdings, digging into a broad-based, consumer and technology oriented portfolio like Tiger Global's can prove a rich source of investment ideas. Many investors view publicly disclosed hedge fund trades as a starting point for further research, a time-honored strategy that may reward those willing to put in a little homework.

As every savvy investor knows, Warren Buffett didn't make billions by betting on half-baked stocks. He isolated his best few ideas, bet big, and rode them to riches, hardly ever selling. You deserve the same. That's why our CEO, legendary investor Tom Gardner, has permitted us to reveal The Motley Fool's 3 Stocks to Own Forever. These picks are free today! Just click here now to uncover the three companies we love.

Reproduction in whole or in part without permission is prohibited.