Hedge Funds Like ETFs, but in a Different Way |

Date: Tuesday, November 26, 2013

Author: Tom Lydon, ETF Trends

Like a lot of professional investors, hedged funds like exchange traded funds. However, the affinity for ETFs displayed by some hedge funds may come as a surprise to some. That is to say hedge funds like to short ETFs.

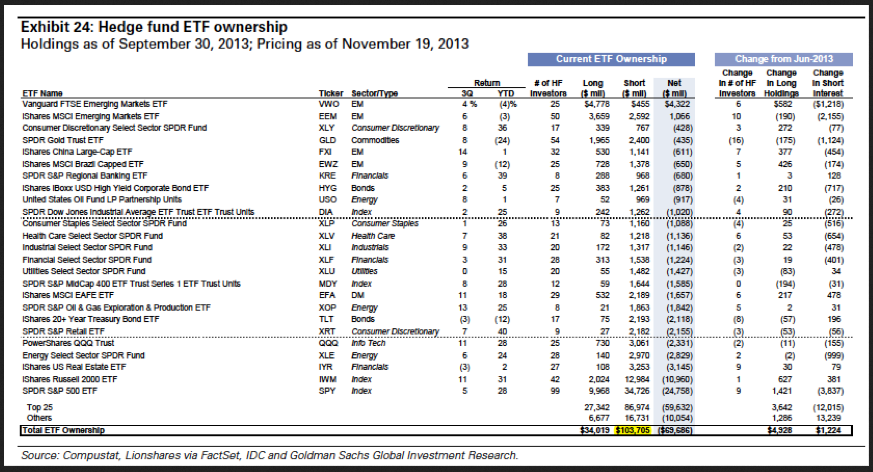

“Hedge funds use ETFs more as a hedging tool than as a directional investment vehicle, based on our analysis of 13-F and short interest filings. We estimate that hedge funds hold $138 billion in gross exposure to ETFs compared with $1.7 trillion of gross exposure to single-stocks. ETFs represent 3% of long holdings, down from nearly 6% in 1Q 2009 but a rebound from recent quarters,” according to Goldman Sachs analysis reported by Saul Griffith of Value Walk.

Hedge funds increasingly using ETFs as, well, hedges runs counter to the application of ETFs by other professional investors. However, it does jibe with increased institutional usage of ETFs. A recent BlackRock (NYSE: BLK) survey of over 1,400 institutional clients, including pensions, foundations and endowments; asset managers, consultants, insurers, and registered investment advisors showed 88% of survey respondents reported using ETFs in 2013, compared to 70% in 2010. [Institutional Investors Boosting ETF Usage]

“It is clear that the lion’s share (75%) of ETF ownership by hedge fund of $138B is accounted for by short positions of $103B,” reports Griffith.

That speaks to two issues with ETFs. First is short interest. Due to the way the creation/redemption process works for ETFs, it is possible for an ETF to have a massive short interest, in some cases double (or more) of its shares sold, which is sometimes the case with the SPDR S&P Oil & Gas Exploration & Production ETF (NYSEArca: XOP) as just one example. However, fears regarding ETF short squeezes are overstated, as BlackRock pointed out in 2011.

“ETFs, unlike individual stocks, can be continuously created in order to meet supply needs in the market. It is happening all the time – when demand outweighs supply in the market, market makers step in to create more shares of the ETF to meet that demand. Furthermore, since market makers may already have some of the component securities in their accounts before they create, the creation process won’t necessarily cause excess buying pressure on the underlying stocks,” said Noel Archard for BlackRock in a June 2011 note.

Additionally, the recent BlackRock survey of professional investors indicates liquidity is one of the primary reasons these investors have warmed to the asset class.

At the sector level, favorite stomping grounds for hedge funds looking to short ETFs include energy and financial services as well as technology and consumer discretionary, according to Goldman.

Popular ETFs that are more heavily shorted by than are owned from the long side within the hedge fund community include the Consumer Discretionary Select Sector SPDR (NYSEArca: XLY), the iShares China Large-Cap ETF (NYSEArca: FXI), the U.S. Oil Fund (NYSEArca: USO) and the iShares MSCI Brazil Capped ETF (NYSEArca: EWZ).

Hedge Fund ETF Ownership