Acceleration in Downtrend for Funds of Hedge Funds |

Date: Thursday, November 21, 2013

Author: Simon Kerr, Hedge Fund Insight

Eurekahedge has just published its annual review of funds of hedge funds. It is difficult to find any good news in it.

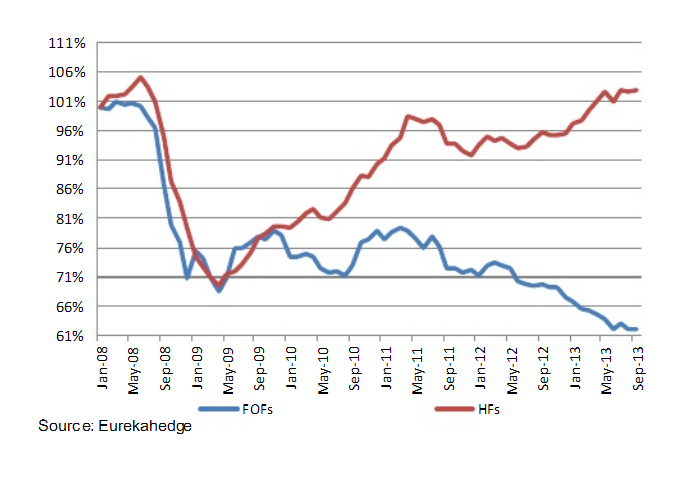

The divergence of the paths since the Credit Crunch of the single manager and multi-manager hedge fund businesses is well known, and is reflected in the time series of aggregate AUMs for the two sectors, shown below.

Comparative growth in funds of hedge funds & hedge fund assets under management since Jan 2008

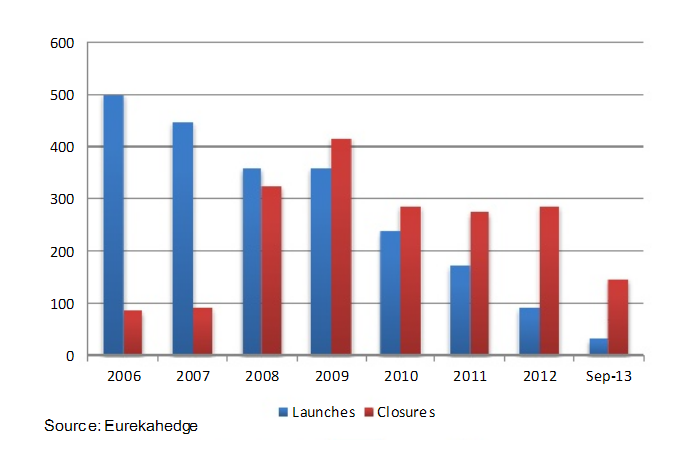

Before the watershed of 2008 each year there were more launches of funds of hedge funds than closures. Since 2008 there have been more closures of funds of funds than launches of funds of funds. So the number of funds of funds continues to shrink, though at a slightly slower rate in 2013 than 2012. The current AUM of the industry is 38.6% below its 2008 peak and stands at US$507.6 billion managed by a total of 3,214 funds.

Launches and closures of fund of hedge funds pre and post Credit Crunch

The table below shows the performance at the index level of funds of funds versus single manager hedge funds. Since most flows into the hedge fund industry for some years have come from investing institutions emphasis should be put on the medium term measures of relative performance.

Performance of single managers compared to multi-manager hedge funds

It is fair to say that investing institutions see the performance gaps in the table to be too big to justify two layers of fees. In a reversal of the position for single manager hedge funds, a more constructive case can be made for larger funds of funds versus smaller ones, as shown in the table below.

Performance across fund of hedge fund size

Source: Eurekahedge

The commercial pressure on funds of hedge funds has brought a number of responses including, the offering of advisory services, bespoke solutions, segregated products, and changes to the terms of business. Before single managers went through the same experience, for a long time (over ten years) fund of hedge funds had the advertised fee structures and lower fees which were actually charged. The advertised rates appeared on databases and presentations and marketing documents. The actual rates were discounted for size through negotiation, often with non-disclosure clauses. So it has been difficult to establish what the average fees paid by investors into funds of hedge funds has really been. However Eurekahedge have come up with a way to show the trend, if not the exact fee level in any one year. The table below shows the average fee structure of funds of hedge funds launched each year since 2005.

Average fund of hedge fund fees by launch year

Another area that changed from the pre-2008 to post-2008 era is in fund of hedge funds liquidity. Many investors in hedge funds found their experience in seeking redemptions in 2008/9 unacceptable. Ever since there has been pressure on single manager hedge funds to increase the frequency of dealing, and reduce the notice periods to deal. The accommodations of the single managers have allowed multi-manager hedge funds to offer better terms too. This reflected in the table of average redemption period for funds of funds shown below.

Average redemption notification period for funds of hedge funds

Pre-Credit Crunch the average notice period for redeeming from a fund of hedge funds was approaching two months. Now the average notice period is just over a single month. According to Eurekahedge as at September 2013, 55.6% of funds of hedge funds have a redemption notification period of less than 30 days while in 2006 this percentage stood at 22.9%.

The consequences of these commercial pressures on funds of hedge funds is amalgamation of firms and funds, as the long term trend of shrinking industry assets continues.

Monthly flows in fund of hedge funds industry in last three years ($bn)

The table of monthly flow data shows some changes in the last three years in seasonality, consistency of flows and total flows to funds of hedge funds. In 2011 and 2012 there were two months of net subscriptions in the Winter. In 2013 there were no inflows in February and March.

Taking a diffusion index approach: in 2011 there were five months with inflows, in 2012 there were three months of net subscriptions, and in 2013 there has been one month out of nine in which investors added to the capital managed by funds of funds. Net subscriptions have become much less frequent.

Finally, looking at the annual figures, there has been a marked acceleration in redemptions over recent years. The 2010 and 2011 levels of net redemptions were broadly similar ($22.6bn and $18.6bn respectively). But last year saw net redemptions of $60.3bn, and this year we are on course for $90bn of redemption from funds of hedge funds for the whole year.

This medium term trend is well known to the owners of funds of funds businesses. The breakdown of the old business model of funds of funds gives some opportunities too. The owners of funds of funds businesses often own single manager hedge fund businesses also, and the single managers can benefit from investors' direct investing. Financial conglomerates often own several investment advisory businesses too, and many funds of funds now accept advisory roles that pay fees. Funds of funds can also earn fees for structuring funds, for running a managed account/segregated fund capabilities and offering multi-manager products in new formats such as mutual funds, as well as fees for due diligence, and risk measurement and overlay services.

All these services that used to be bundled in the funds of funds offering, and have grown out of it, such as bespoke funds for large institutions, will mitigate the impact of AUM pressures. But they will only mitigate them. It still seems as if the downtrend in funds of hedge funds is accelerating.

Reproduction in whole or in part without permission is prohibited.