Hedge Funds Buy Gold by the Ton with ETFs |

Date: Monday, November 26, 2012

Author: Tom Lydon, ETFTrends

Some hedge fund managers are using ETFs to back up the truck and load up on gold.

Hedge fund skipper John Paulson holds about 66 tons of gold through an exchange traded fund as more portfolio managers and individual investors use ETFs to own the precious metal as a hedge against inflation and global debt problems.

Paulson & Co. has a $3.66 billion position in SPDR Gold Shares (NYSEArca: GLD), the largest metals ETF with nearly $75 billion in assets, Bloomberg News reports. The fund controls over 43 million ounces of gold, or about 1,342 metric tons.

Paulson’s stake in the gold ETF is more than the official reserves of many countries, including Brazil, according to the report.

Investors used exchange traded products like GLD to purchase 247.5 metric tons of gold this year, which is more than annual U.S. mine output, Bloomberg reports.

Global gold holdings in exchange traded funds and products are at record levels following the Federal Reserve’s third round of quantitative easing, or QE3. [Gold ETF Holdings Hit All-Time High on Fiscal Cliff and Greece Debt Fears]

Exchange traded products hold about 2,604 tons of bullion valued at roughly $145 billion, exceeding the official reserves of every nation except the U.S. and Germany, according to the article.

Gold ETFs let individuals and fund managers trade and invest in gold without the costs of transporting, storing and insuring the precious metal.

Famed investor George Soros boosted his stake in GLD by 49% to 1.32 million shares in the third quarter, valued at $221.4 million, Bloomberg reports.

“We see gold as a hedge against the follies of politicians,” said Michael Mullaney at Fiduciary Trust, in the story. “It’s a good time to garner some protection in portfolios by having some real asset like gold.”

GLD, the gold ETF, has a five-year annualized return of 15.9%, according to investment researcher Morningstar.

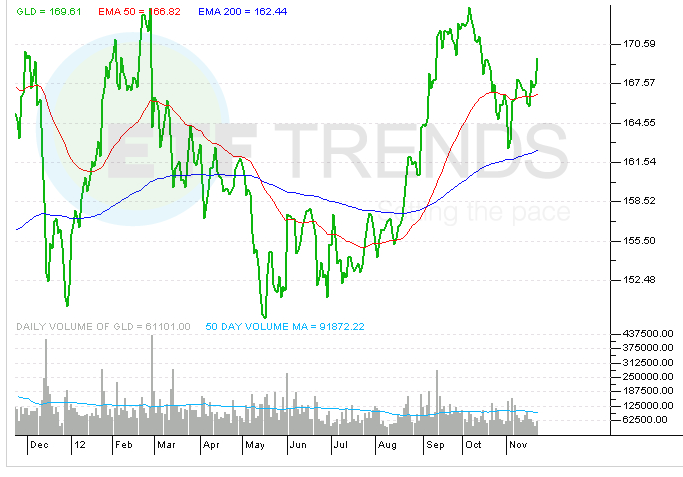

SPDR Gold Shares