Welcome to CanadianHedgeWatch.com

Sunday, February 22, 2026

Macro Managers Coming Through at Last |

Date: Thursday, October 27, 2011

Author: Simon Kerr

One of the disappoinments this year has been the performance of global macro

managers. At the stage of half way through the year, it seemed that if a manager

in this strategy had ridden the wave of QE2 inspired up-moves in equities and

commodities then they gave it back by staying too long at the party, as they

effects of monetary stimulus dissipated in May and from that month onwards.

Those that lost a little in the 1Q may have made a bit back by mid-year, but

there seemed to be too few managers that were able to ride markets in one

direction and then the other with enough conviction or timing to make money

across the whole of their books.

One of things that surprised me at the half way stage in the year was that so few macro managers had made much at all. Some of these big-picture managers tend to have core fixed income books, and others express their views on Chinese growth in the fx markets or in commodities. But they all may be positioned long or short, and they decide their own timing and sizing. So there is a lot of scope for the universe of macro managers to have completely different directional bets in the same market. Those that don't do much in energy, might concentrate on time spreads in softs or run a big book in credit trading. The point is they need not have correlated returns at all - in fact logically the universe of global macro managers should always have the biggest dispersion of returns amongst hedge fund strategy groups, and most of the time it does. By happenstance, taking all these different views and putting on unrelated trades across a wide selection of markets, hardly any macro managers had made good returns by the end of June this year. However the market gyrations of August and September have allowed a different story to be told for the period since.

Only this week Luke Ellis of Man Group was commenting that there was a very

wide dispersion of manager returns amongst hedge funds in August. In

September there was an historic extreme of dispersion of returns amongst

managers running hedge funds. So for observers of or investors in hedge

funds the returns of August and September become much more about which

managers you were in, rather than which startegies you were allocated to.

And practically it means that index or industry level returns for hedge

funds for those two months start to be quite unrepresentative. We are well

used to seeing headlines about "Hedge funds failing to deliver this month/on

the year to date" based on index level returns, and sometimes (more usefully

in this context) about returns across a hedge fund database being "good" or

"bad" or generally different from returns on the underlying markets at an

asset class level.

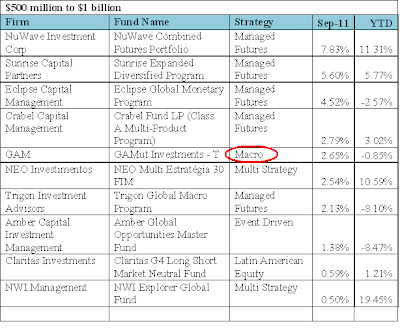

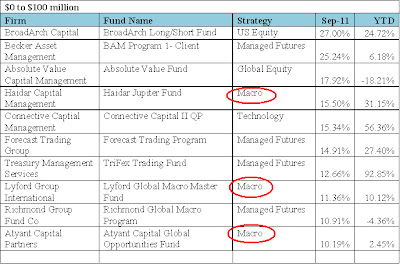

When the YTD numbers are close to zero, the next data point has a big impact

on YTD returns. That is what has happened to hedge fund returns this year,

and for some global macro funds in particular. The tables shown here are

from "Absolute Return" magazine and pick out amongst US-based managers the

best returns produced last month. It is pleasing to see the marked presence

of macro managers at the top of the rankings after the year they have had.

These are good returns of specific managers

in the global macro investment strategy. However, today I see that

The Greenwich Investable Hedge Fund Indices give the index level returns for

macro managers as -0.79% for September and -3.72% for the year so far. My

experience of dealing with investors in hedge funds is that they are looking

at what their specific hedge fund managers have done for them. There will be

nearly no one who has experienced a return from their macro managers of

-3.72% in the year to date (for reasons of position sizing and the timing of

subscriptions and redemptions, if nothing else). Given the extreme

dispersion of returns in September, and that macro managers have the widest

dispersion of returns amongst any hedge fund investment strategy I can

confidently say that no-one except an index investor has actually got a

return of -0.79% from their macro managers last month. The inference is that

the returns of the last two months will tell investors a lot about the

quality of manager selection amongst their advisors and consultants, and

amongst funds of funds. And not just in global macro.

Copyright © Canadian Hedge Watch Inc. All rights reserved.

Reproduction in whole or in part without permission is prohibited.

Reproduction in whole or in part without permission is prohibited.