Welcome to CanadianHedgeWatch.com

Friday, February 13, 2026

Another Year Another Challenge for Funds of Funds |

Date: Friday, August 27, 2010

Author: Simon Kerr's Hedge Fund Blog

In 2008 the fund of funds industry had a tough time

producing returns for investors because only 30% of hedge funds produced a

positive return. For 2009 things were tough for funds of funds as they

couldn't get out of the hedge funds that had let them down by making losses

in 2008, because of limited liquidity in the funds, suspended redemptions,

and sidecars. Further, few of the funds which made money in 2008 made good

money in 2009. So if funds of hedge funds stayed loyal to their winners of

2008 it probably cost them in 2009. There was even a reversal of the size

effect on hedge fund returns in moving from 2008 to 2009.

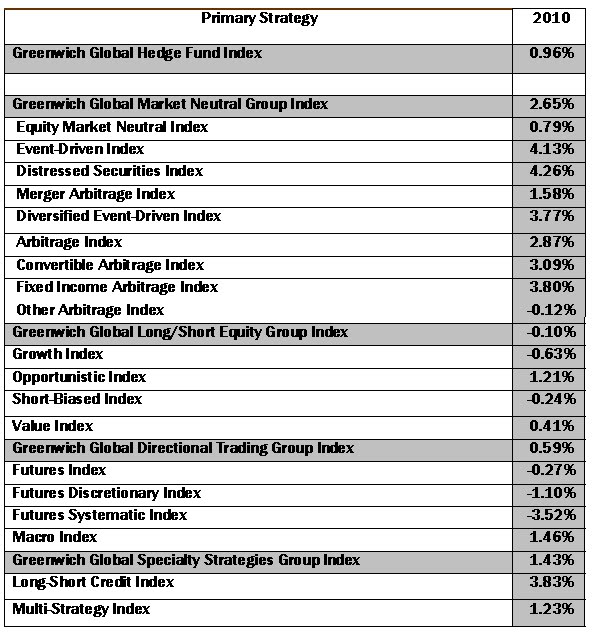

Before looking at hedge fund returns in 2010, and factors

that will impact fund of funds returns, let's look at single manager hedge

fund returns in 2008 and 2009 from an absolute and relative perspective.

2008 was an absolute disappointment in terms of hedge

fund returns- a loss of around 16%. Last year hedge funds produced their

best returns since 1997, at up 19%, by the Greenwich Global Hedge Fund

Index. And year to date through July, the same hedge fund index has a small

positive return (up 1%), which is not good in isolation as an absolute

return over seven months.

The returns from equities put the absolute returns of

hedge funds into some context. Using the S&P500 as a proxy for the

equity asset class, the hedge fund returns of 2008-9 look very different.

The S&P500 was down 38.5% in 2008, the year hedge funds at an index level

lost 16% in a liquidity crisis with high volatility and fraud in the

industry, and even so 30% of hedge funds were up.

In 2009 the S&P500 was up 23.5% and hedge funds were up

19%, which given the constrained directionality (beta to markets) is as good

as it gets for the alternative funds. Over 70% of hedge funds produced

positive returns in 2009.

This year the S&P is down 4.3% at the time of writing,

whilst representative indices of hedge funds are up a small amount. However

the context for hedge fund returns in 2010 is even tougher in some regards

than the previous two years. To begin with, let's look at the trajectory of

the equity market this year. Below is a one year chart of the S&P500.

|

| source:stockcharts.com |

The rally of the second half of 2009 actually peaked in

the first few weeks of 2010, and thereafter the stock market has been a

rollercoaster of epic proportions, meaning a serious of precipitous falls

followed by sharp rises. Monthly index level changes of 7-8% have not been

unusual since the outbreak of the Credit Crunch, but the sequences have

changed: we had a string of big down months in the bear market to the low in

March last year, then a series of big up moves in the massive rally of the

last three quarters of last year. In 2010 we have had big up and big down

moves alternately. Given that managing the net exposure is typically the

biggest risk control variable of most hedge fund strategies (bar the market

neutral strategies), this year has been amongst the most difficult market

direction background I can recall, as the market was aggressively moving one

way and then the other by turns.

Persistence of market movement, or propensity to trend,

is different from volatility in traded markets. It turns out that the actual

volatility of the S&P500 index, as a proxy for global equity markets, has

been both unusually low and then high this year. The chart below shows

30-day historic or actual volatility of the S&P500.

|

| source: Bloomberg LLP |

A level above 25% historic volatility (as opposed to

traded volatility) has been uncommon in equity markets, except for short

periods, and except for the last two years. The shifts in

volatility seen this year would probably have hurt more hedge fund

strategies than they helped. Pure volatility strategies should have

benefited from the April/May shift in volatility, and the delta hedging

of CB arbitrage funds should have had a good background in March and

after the June peak in volatility . Overall 51% of hedge funds by number

had produced positive absolute returns at the half way point of the

year. This hurdle was exceeded by 68% of hedge funds at the end of the

first quarter of the year, so the year has got progressively tougher as

it has gone on - that falling success rate persisted into the end of

August

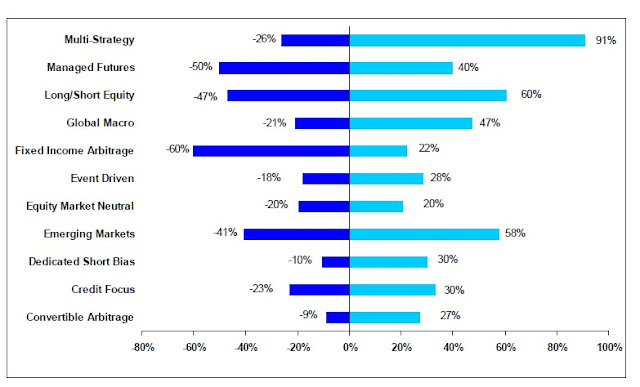

Hedge Fund Returns by Strategy

|

| source:Greenwich Alternative Investments |

Returns by strategy are for the most part marginally

profitable or loss making this year. As this is the case, differences in

index and sub-index construction and scope have produced different outcomes.

What one index provider has as a strategy with a positive return, another

shows a negative return for. Lipper's series of hedge fund strategy indices

has only two strategies out of 13 given producing positive returns this

year. Greenwich Global Hedge Fund Indices show only three strategies with

negative returns in the YTD (out of a total of 15). Both index providers

agree that Long/Short Credit and Convertble Bond Arbitrage are amongst the

best strategies for returns so far this year.

Looking across other index providers (Dow Jones Credit

Suisse, and Hedgefund.net) it looks as if a small majority of hedge fund

indices for strategies produced positive returns in the first seven months

of the year. This hit-rate for positive returns by strategy in combination

with the dispersion of returns within the strategy has some interesting

implications.

Dispersion of Hedge Fund Returns Within Strategies

January-July 2010

Copyright © Canadian Hedge Watch Inc. All rights reserved.

Reproduction in whole or in part without permission is prohibited.

Reproduction in whole or in part without permission is prohibited.